Ramp’s $13B Valuation: Another Fintech Victory Lap We Couldn’t Ignore

Ramp, the “leading financial operations platform” (as they humbly describe themselves), announced with great fanfare that their valuation has ballooned to $13 billion.

While we were busy squinting at prototype phones and pretending to care about 6G at Mobile World Congress, we nearly overlooked yet another fintech patting itself on the back. This time, it’s Ramp, the “leading financial operations platform” (as they humbly describe themselves), announcing with great fanfare that their valuation has ballooned to $13 billion.

Naturally, the press release is chock-full of buzzwords, AI promises, and the kind of chest-thumping that only a venture-backed decacorn can pull off.

The Big News: Investors Are Still in the Business of Giving Ramp Money

Ramp has secured $150 million in secondary transactions, meaning early investors and employees cashed out while new and existing investors doubled down on the fintech dream. Stripes, GIC, Avenir Growth, Thrive Capital, Khosla Ventures, and a who’s who of VC firms are now even more convinced that AI-powered bookkeeping is the financial revolution we never knew we needed.

According to CEO Eric Glyman, Ramp exists to “give businesses back their time and money.” Which is exactly what we thought financial software was already supposed to do. But don’t worry—now it’s infused with AI, which means it’s automatically better, right?

AI: The Magic Word That Gets Everyone Excited

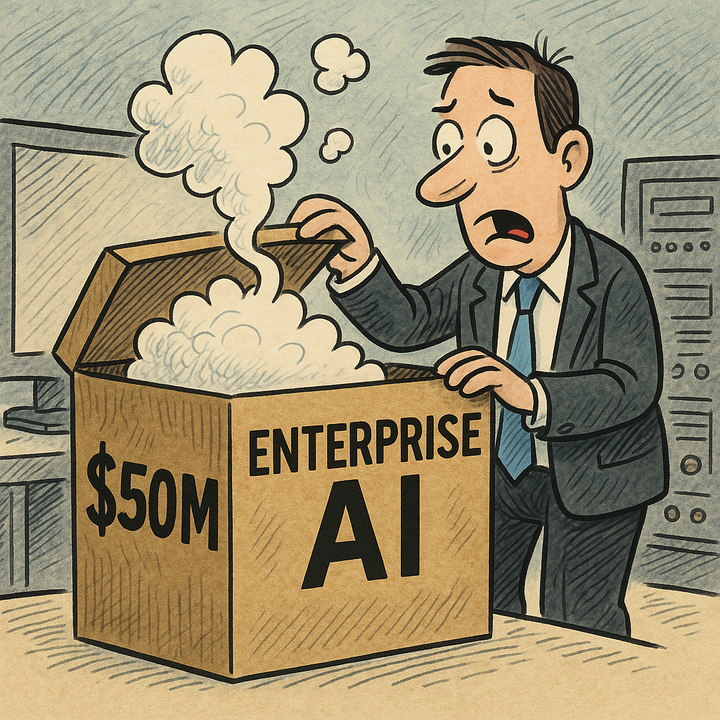

Speaking of AI, Ramp wants you to know they are at the cutting edge of “autonomous financial operations.” What does that mean, exactly? According to Ramp, it means moving beyond mere financial software to something truly automated—like a self-driving Tesla, but for expense reports. We can only assume this also means the occasional budget-crashing “autonomous decision” that nobody signed off on.

Ramp by the Numbers: A Masterclass in Vanity Metrics

Here’s a selection of impressive-sounding figures from the press release:

- $55 billion in annualized payment volume – That’s a big number! But what does it really mean for revenue? We may never know.

- 20 million hours saved – We assume this is based on some very scientific “before and after” stopwatch measurements.

- $2 billion in savings for customers – A figure that, like all fintech “savings” claims, is likely based on a proprietary equation known only to Ramp’s PR department.

The Future: Even More AI, Even Less Manual Work (Until Something Breaks)

Ramp assures us that in five years, we’ll look back at today’s financial operations like we now look at manual bookkeeping, with a mix of horror and disbelief. Of course, this assumes that AI can flawlessly replace finance teams instead of making “autonomous” mistakes that lead to expensive messes requiring (you guessed it) manual intervention.

But the hype train stops for no one, and Ramp is already eyeing further AI expansion, new product lines, and more ways to eliminate “busywork.” At this pace, we might soon see a press release about Ramp replacing CFOs entirely.

Comments ()